Getting insurance for your travel trailer is a good idea. Travel trailer insurance costs might surprise you however. I recently got two quotes on what it would cost to insure my new trailer. I thought I’d just share the results here so you know what to expect.

- Quote #1 from Good Sam’s Insurance: $376 per year with a $250/$500 deductible. I didn’t check to see what their replacement plans were. I’m not sure if the trailer wrecks two years from now if they just give the value that the trailer costs that day, or if they give me the money to buy a new one.

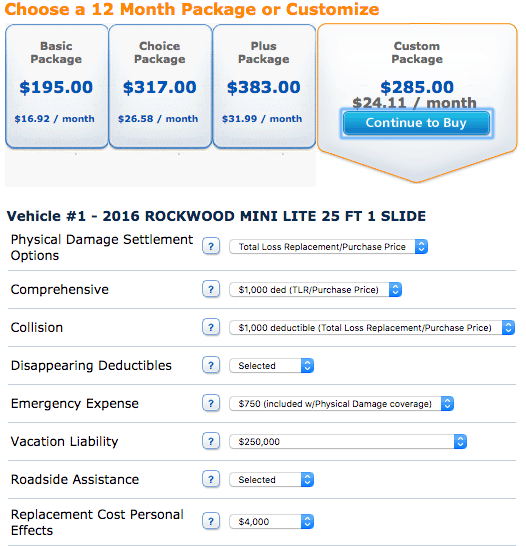

- Quote #2 from Progressive (Via USAA): Depending on coverage, Progressive quoted between $179 and $383 per year. The quote that I’m going with is from Progressive and the final cost was $289 per year. I bank with USAA and I LOVE USAA, but they don’t insure trailers so they passed me off to Progressive. I get a slightly deduction in my car and home insurance through USAA if I get the trailer insurance through their third-party provider. So if you have USAA banking, be sure to go through them.

The Trailer I’m Insuring

Just so that you can ballpark your expense for insurance, the trailer I got the quotes from is a 2017 Rockwood Mini-Light 2504s. I paid $24,500 for it out the door (including, tax, title, fees, etc).

Exampel of Travel Trailer Insurance Costs

The best way to save money, I found, is to get your quote for insurance online and NOT on the phone! When you call in to the insurance place to get a quote, they won’t go through all of the options with you so as to make it less complicated. If you get it online, you can customize your quote to just exactly the coverage you need and nothing more.

I got a quote for $450 from Progressive on the phone, but then I went online to look at the coverage and found the insurance for under $285 for the coverages that I needed, and excluding other coverages that I didn’t need.

Factors to Consider when Buying RV Insurance

Replacement Cost – You have the choice of getting the full replacement cost, or just the actual value of the trailer. In my opinion, it’s worth paying to get the full replacement cost, so if you wreck your trailer 3 years from now, you get a new trailer instead of the value of your depreciated trailer.

Bodily injury – I found that this was actually very inexpensive to add to my policy to get $500,000 of coverage, so I added it. It was only $1 more to get $500k compared to $250k.

Roadside assistance – This one’s up to you. For me, the quote for roadside assistance was about $25 more per year.

Coverage for personal affects – I think this one is extremely important. Generators are pricey and they get stolen ALL. THE. Time! Get your personal affects covered.

In this article, we made a list of all of the things that travel trailer insurance covers. Be sure to check it out to know exactly what will be covered.

Best RV Insurance Companies to Call

It’s certainly worth checking a few companies to see who gives the best prices for camper insurance. Here are a few links to consider:

- Farmer’s travel trailer insurance

- Progressive travel trailer insurance This is the one I chose.

- Geico travel trailer insurance Not recommended to try online! You go through a million questions on their online page to get a quote, but at the end they don’t give you any prices. They just call you and the salesman will drive you nuts.

- Good Sam RV insurance

My Choice of Insurance

Travel trailer insurance cost is minimal. That is, compared to risks you take when RVing without insurance. I’m choosing the insurance from Progressive through USAA. I think knowing the company that is providing the insurance for your RV is important and I’ve always had good experiences with USAA so I think they’d work with a company that would take care of me.

VERY VERY Useful and important information!!!

Thank You

Jim, thank you for this article. I feel like we are paying way too much. I tried Farmers Insurance but you can’t get an online quote from them. We currently have Progressive through USAA (we love them too) but they are charging us over $1000 a year for our travel trailer (2021 Winnebago Voyage 2831). We only took it out last year for a total of 22 days. I can’t figure out why that would be so much but I plan to call them (can’t do it online since we already have insurance through them). I went through the whole thing to find that out at the end. But I got a lot of information from your article and thank you so much.

Thanks, Jim, we appreciate your work here as we’re researching buying a new unit this spring. I’m sorry, Bloggin Brandi, you had a bad experience. I, too, used Progressive4USAA and had the perfect experience and will use them again. (However, nothing inside my trailer was ruined when my trailer was totaled…so not sure how that part works.) After a major learning experience about poorly-made Chinese tires while driving along in rural Pennslyvania many, many, many miles from home (and why I should have installed a TPMS), my total replacement insurance resulted in Progressive’s action to: 1) immediately reimburse my night-of-accident costs, 2) recommend a repair facility nowhere near my original dealership’s horrible repair department, 3) conferring with the TT maker and then the chassis manufacturer to determine if the shop’s recommended repairs would make it road worthy again, 4) and, when the manufacturer said it would not, offering to have their sub-contractor deliver a new (or used unit at lease one year newer than ours) to the location of my choice at the time of my choice. Finally, when I explained we were in the market for something bigger to tow with our recently purchased F250 diesel, the adjuster offered to (and did) issue a check as soon as I got to their closest office with my purchase receipt, title and lvlywf (to cosign, of course).

While this happened to us in 2015, I also, recently, received a recall notice in the mail indicating that I should bring my TT into a shop to have the chassis reinforced because a flat tire while driving could result in the back-axle being ripped off and the chassis breaking in 4-5 places… y’all are welcome.

Signed, Patient Zero. 🙂

I have USAA and had Progressive for my travel trailer until I was in a bad accident. Take it from me, I had all my receipts and documents. Photos, videos and NONE of my personal belongings were ever made whole. I lost so much and spent a year recovering in a medical facility. I would warn anyone who hasn’t had to file a claim with Progressive to think ahead. Even now with my Class B Van they are the cheapest, but I refuse to do business with them. I love USAA and NEVER have issues with them. I will pay more for insurance just to have piece of mind. Now, I went through Good Sam for insurance and they gave me a quote for Foremost. That is who I use now. Always do your research, read reviews, see what others have experiences. So thankful for all the info out online to help with these decisions and people sharing their stories!

Jim – we are looking to buy a used motor home that has high resale value – any suggestions – spending limit is $90,000.

Great article. Very informative and helpful. After dragging my feet for a couple of weeks I got serious and shopped. I would never have gone with Progressive if it had not been a suggestion of yours, they’re just not on my radar. But am I glad I did! Very user friendly website and affordable. Bought my first Travel Trailer, a 34′ 2018 Jayco 29BHDB, which I paid 32K for with upgrades, that I was able to insure for $234/mo. Thanks for the advice and keep up the good work!

I must be doing something wrong. I have a 2017 Wildwood travel trailer, with USAA…through Progressive…$64 a month!!

I’m looking to purchase a 2017 Towable camper. I checked with pur insurance “St. Farm” they based the quote on the MSRP price not what we are actually paying for it, which is good bit of a difference. Does anyone know if this is what they have to base the insurance off of?

I have USAA, which goes through Progressive for RV insurance. I have a new travel trailer bought at the very end of the season, so it hasn’t done a trip yet. Not until next Spring. Does anyone have USAA/Progressive? If so, do they offer seasonal insurance? As in, I don’t want to be paying on the insurance while it’s being stored at my home during the off-season.

Be careful with USAA, they left us high and dry after a stolen vehicle.

Agree, just Google USAA for the BBB. Even the federal government has investigated and sued them. They have been sued so much or really sad stories of those ripped off, they refuse to help. They are complete dirty company, not like the old days. Beware!

Things go wrong with campers when they are stored. Storms, trees fall, theft, never cheap out on insuring your investment.

This was SO helpful. Thank you for writing this.

Really appreciate your time and effort to put this out there

Thank you. VERY helpful info. Thanks for putting this out there.

We just bought a 28′ Winnebago Minnie, don’t know if that was a mistake or not. Past use of a Winnie was good and we liked the floor plan with its two entry doors and two to bathroom so we won’t disturb each other at night.

We too have USAA and haven’t called yet.

Finding your blog is wonderful and oh so helpful. Thank you for taking the time to share your experiences. If I start a blog, I’ll refer to yours.

Our new fifth wheel is a 336TSIK, considered 33 ft, six inches long, as that’s what’s pulled behind truck. If you measure from nose (over truck bed) to bumper, it’s actually 36’11”. Our broker says this unit is unstable to pull because of the length, that most with trailers over 35 feet park them permanently, that it can’t/shouldn’t be an add on to an automobile policy but should be added to home insurance policy (in order to get full replacement costs instead of depreciated value) so our total will be $1,100 year!!!! Holy smokes – this is crazy. I think they’re confused about trailer length of fifth wheels. It shouldn’t be rated as a 36 ft travel trailer if it’s a Chaparral 336.

Hello, question…. we bought a vintage travel trailer on EBay. The shipper has cargo insurance as he toes it to us. So, do we insure it now or once it is delivered to us?

This was helpful! We’re looking to buy our first travel trailer and I didn’t even know where too start looking at insurance!

So glad I found this sight. We re in the process of choosing our first travel trailer. I just checked with my insurance agent to get quotes based on our current trailer selection, and asked about all the items you mentioned above, so this article really helped me understand the different needs. My reason for responding concerns liability. I am a sports official, officiating at all levels up through High School. While the organizations I belong to have liability coverage for their officials, I carry an extra $2M umbrella policy. Cost is only $170 a year and is well worth it. Check with your insurance agent.

Thanks for the information. I do suggest to check the math on the personal effect coverage. Although generators get stolen all the time, the generator you(and I) chose is the same price as the deductible for that coverage.